- Home

- Campaigns

- Research and policy

- Extra burden of energy among disabled households

This briefing note contains our latest data and analysis, carried out with other institutions.

We look at how disabled people have been affected by the cost of living crisis.

We give our recommendations to the government on supporting low-income disabled households. And those with higher energy usage.

Life has always cost more for disabled people

The extra cost of disability pre-dates the cost of living crisis.

Our Disability Price Tag 2023 research finds that, on average, disabled households need an extra £975 a month. This is to achieve the same standard of living as non-disabled households. This figure is updated yearly. Check the latest figure.

This extra spending includes:

- specialist disability-related products and services

- spending more on everyday things

- higher usage of essentials

Linking disability and poverty

Many socio-economic factors make resilience to significant financial turbulence harder for disabled people.

As a result, there is a link between disability and poverty.

50% of people in poverty in the UK are disabled or live with a disabled person. Poverty Strategy Commission Interim report

Often the extra cost of disability is not considered in measuring income poverty. This under reports poverty among disabled people.

The Social Metrics Commission includes extra costs in their poverty measure. But these are estimated by payments of Personal Independence Payment (PIP) or Disability Living Allowance (DLA) benefit payments received.

We make the case for measuring extra costs which accounts for the additional need and spend on essentials that disabled households have. This cost is generally higher than disability benefit payments.

We commissioned WPI Economics to look at spending on essential items. We want to understand these costs and their impact on:

- financial security, and

- health and wellbeing

In collaboration with WPI Economics, we compared spending patterns of disabled households against their non-disabled counterparts.

This analysis looked at differences in socio-economic and demographic characteristics.

- Housing tenure

- Size and composition of household

- Age, and

- Ethnicity

This is crucial for developing policies to deal with the extra cost of disability.

Extra cost of essentials for disabled households

Since the pandemic, prices of essentials have risen more quickly than non-essentials. Disabled households give more of their budget to buying essentials. The impact of the price rise is greater for these households.

We have called this the extra burden of essentials. Disabled people have less money left for disability-related costs and discretionary spending.

When we account for the increased cost of essentials. We found that on average a household with a disabled person:

- have lower incomes and spend a greater proportion of their budget on essentials such as, food and energy

- spent 31% more a week in 2023, than they did before the pandemic. That is equivalent to around £3,068 a year (assuming they maintain the same spending patterns throughout)

- spent 8% of their budget on energy compared to 6% for non-disabled households. That is an extra £12 a week or £634 a year

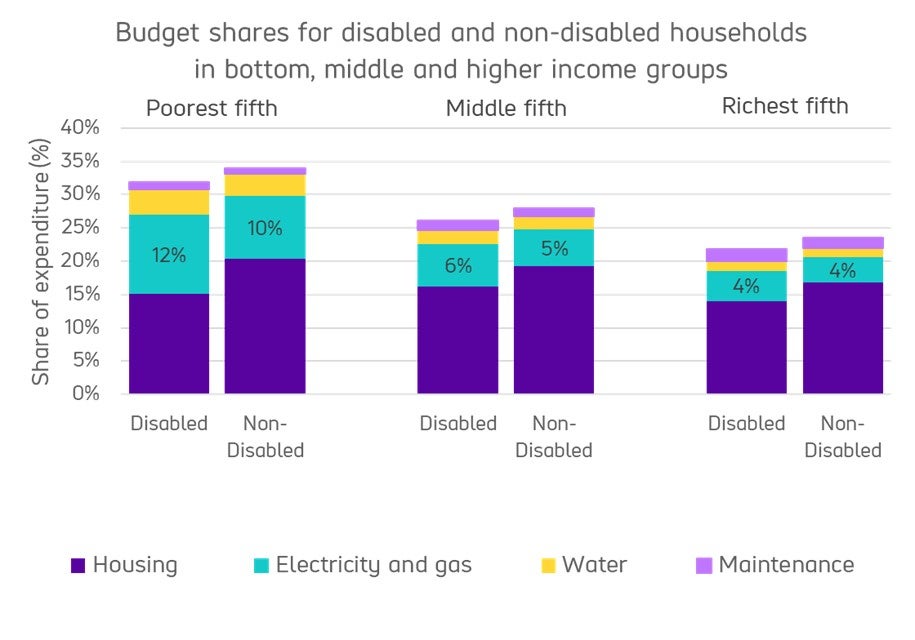

- In the poorest 20% of households, disabled households set aside more of their budget for energy than non-disabled households. 12% compared to 10%.

We worked with WPI Economics analysing data from the Living Costs and Food Survey from 2017 to 2020.

Using different households’ income groups, WPI Economics linked these datasets to the Family Resources Survey 2019 to 2020, creating a combined dataset.

Share of budget spent on essentials

The graph below shows how much of a disabled household’s budget is spent on essentials, compared to non-disabled households.

This comparison is made across the bottom, middle and higher-income groups.

Disabled households disproportionately affected

Soaring inflation in food and energy prices have hit households hard over the past 2 years.

The quarterly energy price cap (October to December 2023) is currently at £1,823 a year, way above the £1,000 average before the war in Ukraine in early 2022.

The energy price cap for the first quarter next year (January to March 2024), will be £1,928. This is on average for a typical household. That is a 5.7% increase on the previous quarter.

Energy price rises have hit low-income disabled households the hardest, WPI Economics extra burden of energy briefing note.

This is because they spend more on energy than non-disabled households.

Looking at energy price rises over the last 3 years:

- the poorest 20% of households face additional energy costs of £4.05 a week

- the second poorest 20% experience additional energy costs of £5.80 a week

At 2023 prices:

- £4.70 a week for the poorest 20%, and

- £6.70 a week for the second poorest 20%

We uprated for 2023 based on the Consumer Price Index inflation rate of 15% (2019 to 2022).

This is money that would have been available to spend on:

- additional disability-related costs

- discretionary spending

Household finances: the effect of the cost of living crisis

Analysing the latest wave from Understanding Society, we found that disabled households are more likely to experience problems with housing costs and debt.

- 12% had problems paying for housing, including rent and mortgages.

- 8% had problems paying utility bills.

Compared to non-disabled households, where:

- 7% had problems with paying rent and mortgages

- 5% had problems with paying utility bills

Disabled household are more than twice as likely to rely on food banks to get by.

Charlie, 50s, South East England

I want a social tariff for energy. [...] What that would mean to my quality of life would be incredible. I'd be able to go on a holiday, I'd be able to buy a wheelchair, I'd be able to pay for my medicine, I would be able to go to the cinema and I'd be able to eat without going to a food bank. It would change my life.

The Office of National Statistics reported 41% of disabled adults were experiencing difficulties affording their housing costs. Compared to 25% of non-disabled adults.

For adults receiving benefits or financial support.

- 45% of disabled adults were finding it difficult to afford housing costs

- 33% of non-disabled adults had the same difficulty

Precarious financial position, struggling or going without essentials

Scope’s own research using Understanding Society, wave 12, 2021, which included 40,000 households, found:

- 12% of disabled households experience problems with paying housing bills

- 8 of disabled households experience problems with paying other bills

- 5% of disabled households use food banks

The Office for National Statistics' Opinions and Lifestyle survey 8 February to 1 May 2023, found:

- 41% of disabled households had difficulties affording rent and mortgage payments

The Joseph Rowntree Foundation surveyed 4,000 low-income families between November 2022 and May 2023. They found:

- 71% of families with a disabled person were going without essentials

University of Bristol found:

- 29% of disabled household were finding it hard financially on a daily basis

Our own opinion research polling of 2,000 disabled and non-disabled individuals between 13 and 20 September, found:

- 29% of disabled people had built debt in the past year

- 38% of disabled people were not using heating

- 34% of disabled people were buying lower quality food or missing meals

- 20 of disabled people were cutting back on showering or bathing

Suzanne, 40s, East Midlands

I'm at the point where I'm having to have things on finance, having to take out lines of credit […] I haven't sunk [into debt] but that's because I've been taking all the measures I could to not. But there's only so much you can trim off before it is as reduced as it can be

The Joseph Rowntree Foundation (JRF) documented persistent financial hardship and food insecurity. But disabled people have been affected more.

JRF found that 71% of low-income disabled households were going without essentials. Even after receiving government cost of living payments.

This is compared to 59% of households without a disabled person (November 2022 to May 2023).

JRF also conducted a survey of people in destitution in 2022.

62% said their daily activities were limited. This was because of a chronic health condition or impairment. Up from 54% in 2019.

The University of Bristol’s research into the financial wellbeing of disabled people noted that many disabled people find it hard to manage daily finances.

29% of disabled people said ‘it is a constant struggle’ to pay their bill during the cost of living crisis.

Jo, 40s, Yorkshire and Humber

The only thing that I could really do at this stage, that would reduce my outgoings, is to drop the car and just not leave the house.

Charlie, 50s, South East England

Every day I'm just so stressed from the minute I wake up to the minute I go to sleep, it's just this absolute cycle, frenzy of, 'What can I do to shave money off and have enough money to survive?' It's so profound because it is all about survival

University of East Anglia, UK Energy Research Centre and National Energy Action found a significant link between disability and household with low energy resilience.

Individuals living in social rented accommodation tend to be in properties that are not energy efficient. They often have low-incomes and disabled member(s) in the household.

Liane, 30s, South West England

Energy costs are my biggest worry, it's spiralled so badly out of control. [...] Energy bills send the fear of God into me. There's a lot of shame with it as well. [...]I've got about £5,000 that I owe in energy because I just haven't been able to physically sort it out. It's really difficult.

Our ‘Winter Concerns’ survey looked at the experiences and concerns of disabled households during the current cost of living crisis.

For this coming winter, it found:

- 38% of disabled people surveyed said they were not using heating when cold. This is comparted to 25% of non-disabled adults

- 34% of disabled people surveyed said they were buying lower quality food, skipping meals or eating less. 18% of non-disabled adults said the same

- 20% of disabled people surveyed they were cutting back or stopping showering and bathing. This is compared to 8% of non-disabled adults

Suzanne, 40s, East Midlands

I can count the number of times we had the heating on in winter on one hand, because I knew that if I did, I would be faced with bills that I would find it very difficult to stay on top of

Our Disability Energy Support service supports disabled people who are struggling with energy bills. Or those who need to make their home more energy efficient.

47% of the disabled people who contacted the service between August 2022 and September 2023, were in arrears with their utility bills.

Concerningly, of those who shared their financial situation:

- 55% were in debt with 1 utility type

- 39% were in debt with 2 utility types

- 6% were in debt with 3 utility types

Those in debt owed £1,048 on average, over the year. This rose to £1,794 when looking at September 2023.

Of the 313 households on prepayment meters (PPM), 50% had outstanding gas debts above £500.

37% were using medical equipment at home, with 19% struggling to keep equipment powered.

Health and wellbeing: the effect of the cost of living crisis

Our Living with Extra Costs interviews explored the links between energy usage and disabled people’s health.

Many disabled people need more electricity for disability-specific equipment.

Others need heating at a constant temperature to manage pain. The need to use energy means higher costs when impairments or conditions worsen.

Our Scope supporter survey asked 900 disabled people, what steps they are considering taking this winter.

Worryingly, it showed:

- 21% may have to go without essential medication and treatment

- 18% may need to stop using electrical equipment

- 8% may have to sell mobility equipment such as scooters

Robin, 30s, South East England

I suffer with skin rashes and lots of skin conditions and infections and all that kind of stuff, especially in the summer. So, I wash my clothes more regularly than most people and it's keeping me healthy, which is great. I think we do the laundry about seven times a week

Hanna, 40s, Wales

I spent my winter without heating […] but I was so cold I didn't realise that when they say if you're disabled you should have your temperatures at nineteen degrees, there's a reason. Sixteen degrees is my favourite temperature, you can put on a jumper, you're still comfortable. Thirteen degrees you get respiratory problems. Eleven degrees your brain starts to, kind of, shut down and you think really stupid things. […] my brain at eleven degrees was not functioning at all.

The Glasgow Centre for Population Health and the Glasgow Disability Alliance found that disabled drivers used their vehicle less as fuel costs went up. For some this resulted in missed medical appointments.

Among those with limited finances, it damaged their social connections.

COPH GDA research participant

My car is my independence; it’s my lifeline to the outside world. Without it, I am housebound. I’ve had a good few times recently where I cannot use the car, it’s had no petrol in it and I’ve been you know, like 10 days before I get my PIP – so it’s just sat there and I’ve been sitting there as well, doing nothing, no social interaction, nothing.

Outlook for disabled households

The NEA estimated that energy bills will be 13% higher compared to last winter. This is due to the absence of the £400 discount on energy bills seen last year. The energy cost gap is particularly large for low-income groups.

We calculated average energy bills by different income groups.

We used energy price forecasts for the first quarter in 2024, and estimated energy bills for 2023 and 2024. We compared these costs against energy bills in 2021 and 2022.

For the poorest 20% of households, energy costs are expected to increase by around 45% in this financial year.

Note Is the government doing enough?

We asked: "Do you think the government is doing enough to support disabled people with the extra costs of energy this autumn and winter?”

- 82.63% said nowhere near enough

- 13.70% said not quite enough

- 1.94% said don’t know enough

- 1.29% said just about enough

- 0.43% said more than enough

It is clear disabled people are struggling.

Hanna, 40s, Wales

…Energy companies are intentionally making it difficult for you to choose the best [deals]…Why is there no social tariff within the energy companies? […] Why are pre-paid meters charged more than people on direct debit? Because the people on direct debit can afford their energy. I feel the energy companies and energy crisis are definitely taking advantage of the less well off.

We welcome the cost of living payments and other financial support in the last 2 years. Yet, they have not met the needs of disabled households.

The Resolution Foundation also notes that living costs payments have not been enough.

'Gotta get through this' research (Resolution Foundation)

Linking eligibility of living costs payments to only those who get benefits led to many households missing out. An estimated 2.3 million households do not receive means-tested benefits. These are the poorest 20% of households and many disabled households are among them.

Recommendations for government

These are our recommendations for government over the short, medium and long term.

Short term (winter 2023 to 2024)

Urgently launch the promised government consultation on an energy social tariff.

Expand the eligibility criteria for the £300 cost of living payments so that disabled households in receipt of contribution based or new style ESA are eligible.

Deliver an additional disability cost of living payment of £150 to people in receipt non-means tested benefits.

Medium term (in time for 2024 to 2025)

Reinstate the Warm Home Discount for the 300,000 disabled people who lost this vital support due to changes in eligibility criteria. This includes people getting legacy benefits and people who receive Personal Independence Payments.

Ban of forced installations of prepayment meter (PPM)’s for all disabled households. Explore a PPM amnesty. So that disabled households with a PPM have the opportunity to have it uninstalled and to receive adequate compensation.

Extend the Energy Price Guarantee for disabled households beyond March 2024, until a social tariff is introduced.

Long term

Introduce a government-funded energy social tariff for disabled households.

Appendix: Scope analysis and commissioned work

WPI Economics: analysis of extra burden of essentials

Scope commissioned WPI Economics to investigate the extra burden of essentials which disabled households face. This analysis explores how differences in household spending are affected by the presence of disabled individuals in the household.

Living with Extra Costs: qualitative research and diary study

Scope complemented this analysis by collecting a weekly household costs diary of disabled households. The diary covered a range of essential spending and extra disability-related costs. Interviews were also conducted with a disabled member or representative of the household. This helps to understand their experiences of financial decision-making and managing their household finances at the current time. And how this position impacts on their families’ health and wellbeing.

Scope Winter Concerns survey

Scope’s recent ‘Winter Concerns’ survey focused on the experiences and concerns of 1017 disabled households on managing through this coming winter.

Disability Energy Service activity

Statistics from our Disability Energy Service – a helpline and advice service. This supports disabled people struggling with energy costs. The information covers the period of September 2023.

Scope supporters survey.

Online survey of 927 Scope campaigners (September 2023), exploring cost of living crisis issues and the impact on disabled households. Note that not all respondents answered all questions. This means for some questions will have under 927 respondents.

Disability Price Tag 2023

In calculating the latest Disability Price Tag figure, we used a Standard of Living approach consistent with our previous research.

In 2023, we looked at survey data from 2019 and 2020. It showed how much extra money families with disabled members need. This estimated the additional income disabled households would require balancing out the extra cost of disability.

This includes areas of expenditure to pay for their additional spending on:

- Specialist disability-related products and services: These are essential and often costly. They include things like vital specialist equipment, mobility aids, car or home adaptations, medicines, and therapies. These are all expensive.

- Needing to spend more on everyday things: Booking a holiday may lead to extra costs due to a lack of availability of accessible rooms. Limited mobility may mean needing to buy more expensive ready meals or rely on the delivery of household goods more.

- Higher usage of essentials: Many disabled households need to use more energy or may need additional accessible transport options.